Australian Production Outlook Continues to Improve

Chris Nikolaou, 17 September 2025

The outlook for Australian wheat production is improving after what was a late and difficult start for many. Local grain prices are reflecting this improvement. Meanwhile, the global wheat market has softened after initial concerns over the Russian wheat harvest. Stateside, a near perfect growing season for corn has been spoiled by an extremely dry August and September taking the top off the record crop.

Australian wheat production outlook

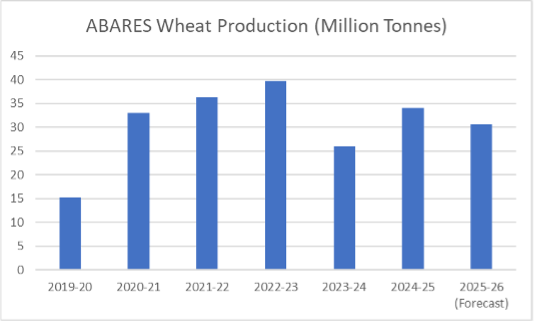

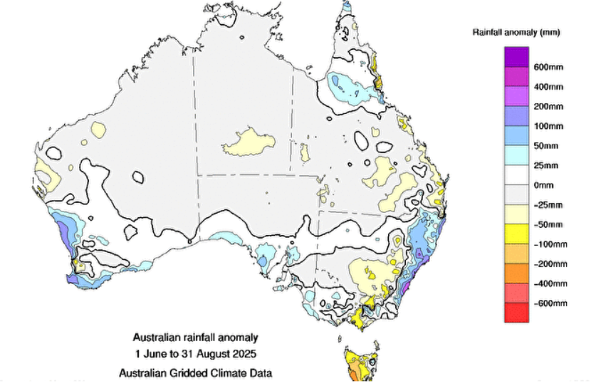

After a challenging 2024 for many in Southern NSW, VIC and SA, the first half of 2025 did not fair much better. It was not until late May that many producers in VIC and SA received their autumn break. However, since that point in time conditions have continued to improve with current vegetation health indexes for most of the country scoring high. However, there are parts of southern NSW and the Mallee through both SA and VIC that continue to do it tough. In their September crop update ABARES stated the “national winter crop production to increase by 2% in 2025-26 to 62 million tonnes, the third largest crop on record”. They explained that most regions had received timely rainfall and pegged the upcoming harvest for wheat at 33.8 million metric tonnes (MMT) which would be a great outcome if achieved.

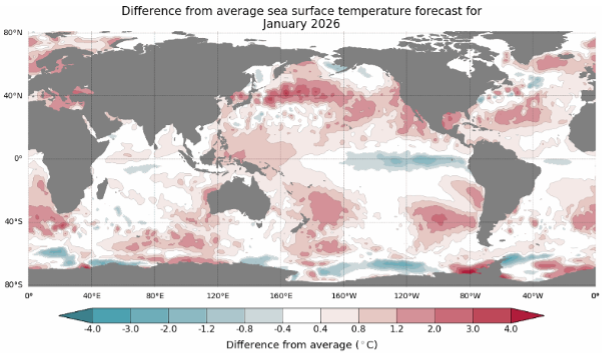

However, spring weather will set final yields and the next six weeks are important. The current outlook is for a neutral to dry back half of September before seeing rains return in early October. There is also concern that a wet harvest could impact grain quality.

Russian harvest improves after a slow start

Russian wheat values rallied $20 per metric tonne in July and August as initial harvest yields disappointed. This was a boon for Australia as local exporters reported an increase in demand for nearby wheat, business that usually went to the Black Sea exporters. However, as harvest has progressed into the northern areas that were less drought affected, yields have improved and prices have come back down. Local analysts are calling for a national crop of 87MMT which is up slightly from last season. On a side note, there has been discussion this season on the toll the war in Ukraine has taken on the Agricultural industry in Russia. Both labour and imported parts are hard to come by. Also, the war economy has led to extreme inflation and local interest rates have been set at over 20% to taper it back. However, the impact for Russian growers is that they cannot afford to borrow funds to finance their farms. They have done well with timely rains to produce the crop this season, but the war and its economic issues will continue to take a toll on the industry as long as it continues.

Banner US corn crop goes backwards

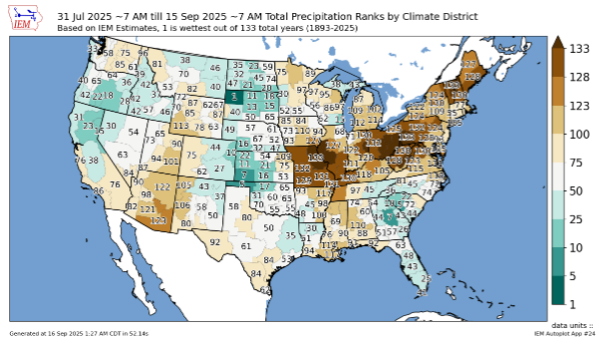

After a dry start to the year, US and Canadian weather also improved from May forward. Rainfall was so widespread and abundant that the USDA pegged a record yield in their August supply and demand reports. However, it now appears this was too early for much of the corn belt. From August forward rainfall has been extremely sparse with areas under drought conditions expanding and the expected yield is dropping. The graphic below is from Iowa State University and measure rainfall for the period against 130 years of historical data. You can see the northern and central plains have faired well. However, much of the central and eastern corn belt is facing a scoring in the bottom of the last 130 years of rainfall data.

Effects on local pricing

Wheat prices have declined locally as the expectation for this coming season’s crop have improved over the last three months. However, we are not out of the woods yet as the most important part of the season is upon us for yield development. If it goes the other way and we are too wet, quality concerns can be expected, particularly in Northern NSW and QLD. Globally, supply is there for now, but the Russian industry has structural issues and the US corn crop is going backwards. Current prices are not great but there is the potential for an improvement in the months to come.

As harvest edges closer and global grain pricing influencers continue to fluctuate, now is a good time to think about your grain marketing strategy and cashflow needs for harvest. Advantage Grain’s best price averaging grain pools offer three payment options; advance, monthly and deferred, to meet your cashflow needs during harvest, and throughout the season. For more information on our marketing programs or a discussion on your marketing strategy for the season, visit advantagegrain.com.au or give the team a call on 1300 245 586.